President Obama’s Clean Power Plan prompted companies to expand transparency about their carbon emissions.

Over the last two decades, the U.S. Congress has been unable to reach agreement on environmental protection, energy, and other legislation central to climate change—but not for a lack of trying.

Multiple proposals related to climate change have either died in committee or failed a vote in the Senate or House of Representatives. The most promising of these proposals was the American Clean Energy and Security Act, popularly known as the Waxman-Markey bill, which the House approved but which did not survive a 2010 filibuster in the Senate.

Following the death of the Waxman-Markey bill, federal efforts shifted to climate regulation by “bureaucratic policy design”—that is, policy established not by Congress but by the U.S. Environmental Protection Agency (EPA)—an approach which some scholars have argued allows for more effective policy than that designed by legislators who have incentives to respond to vested interests. In June 2014, EPA proposed the Clean Power Plan (CPP) under the authority of the Clean Air Act. EPA issued its final CPP in August 2015, establishing standards on carbon dioxide emission performance rates for new coal and natural gas-fired power plants.

My research, presented earlier in July at the National Bureau of Economic Research, shows that even though legal challenges and a new administration have kept the CPP from ever taking official effect, it still prompted proactive climate action by corporations. Indeed, this research shows that credible and stable regulations are necessary conditions for proactive private-sector climate action.

Using a quasi-experimental design, I examined the factors that shaped participation by Fortune Global 500 companies from 2011 to 2015 in making voluntary carbon disclosure—a form of industry self-regulation in climate mitigation. My research demonstrated that impending regulation—particularly in the form of the CPP—was a key driver of voluntary carbon disclosure in the United States.

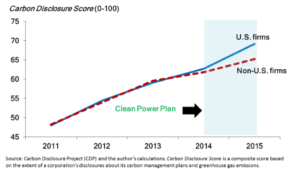

From 2011 to 2013, the average level of voluntary carbon disclosure for U.S. companies was about equal to that of non-U.S. firms, as measured by the Carbon Disclosure Project and expressed in a “carbon disclosure score.” But, as the figure below shows, the two sets of carbon disclosure score series diverged in 2014, the year the EPA introduced the CPP. At that time, U.S.-based firms experienced a sharper increase in voluntary carbon disclosure.

Level of Voluntary Carbon Disclosure for U.S. and Non-U.S. Firms, 2011-2015

To test whether the impending CPP was responsible for this divergence, I employed a statistical approach that models a company’s choice about its level of carbon disclosure, after accounting for the firm’s likelihood of participating in voluntary carbon disclosure in the first place.

To draw a causal inference, I relied on two sources of variation. First, in 2014 and 2015 U.S.-based firms were subject to the introduction of the CPP, a regulatory threat not experienced in the same way by non-U.S.-based firms. Second, firm-level variation arose from the existence of an executive-level manager dedicated to climate change mitigation, which is not present in all firms. I hypothesized that companies with favorable management structures and practices would respond to regulatory pressure in an attempt to earn goodwill with regulators and to avoid costly liabilities compared to firms without the same managerial capacities.

My paper’s quasi-experimental results show that, after EPA’s introduction of the CPP, U.S.-based firms were more likely to participate in voluntary carbon disclosure than non-U.S.-based firms. Taken together, the results also indicate that, after the introduction of the CPP, U.S. firms with climate change managers were about two times more likely to participate in voluntary carbon disclosure.

For corporations with existing managerial capacity, the cost of voluntary carbon disclosure was relatively low since they were more likely to be equipped for climate change mitigation than their counterparts without a dedicated manager. Among firms making voluntary disclosures, the CPP was associated with close to 14 additional points—out of 100—in the carbon disclosure score in firms with a climate change manager compared to firms without a dedicated manager responsible for carbon risk management.

My analysis also delved deeper into specific sectors. I found that, after EPA’s introduction of the CPP, firms with climate change managers operating in the greenhouse gas intensive sectors—energy, utilities, and materials—were two to three times more likely to participate in voluntary carbon disclosure. These firms also disclosed information about their carbon management and greenhouse gas emissions at levels 8 to 18 points higher after the CPP’s introduction than ones in the same sector but without managerial leadership and capacity to address climate change.

In August 2018 President Donald J. Trump proposed to replace the CPP with the Affordable Clean Energy rule, which the current Administration argues “empowers states, promotes energy independence, and facilitates economic growth and job creation.” Although President Trump’s replacement for the CPP grants individual states more authority to make their own plans for regulating greenhouse gas emissions from coal-fired power plants, the Administration does not set minimum federal standards by which states and companies would comply and benchmark their greenhouse gas emissions production and management.

The Trump Administration’s replacement of the CPP will likely hamper proactive actions taken by the private sector and the states and will only delay the power sector’s move away from coal toward renewable energy sources. Ultimately, the most effective incentives for industry-led climate mitigation and adaptation come from stable regulation, including impending regulation that is viewed as a credible regulatory threat, and legislative flexibility for the private sector and the states to exceed minimum federal standards when it is cost-effective for them to do so.