In the 2022 Distinguished Regulation Lecture at Penn Law, CFPB Director urges regulators to take action against corporate recidivists.

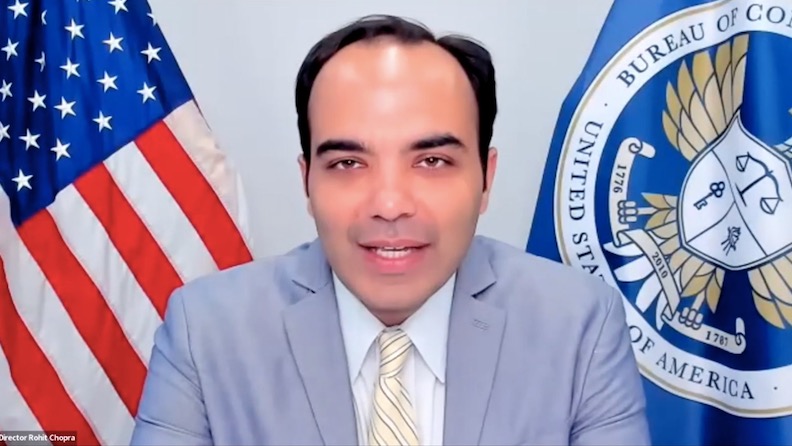

In this series of essays drawing on his 2022 Distinguished Lecture on Regulation at the University of Pennsylvania, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB), argues that large corporate and financial institutions have repeatedly violated the law and past orders. These entities face a low probability of detection of violations and consumer abuses, and even when violations and abuses are detected, ensuing government orders fail to deter future misconduct. Instead, big corporations view such orders as a “cost of doing business”—and American consumers are not only harmed but also left to subsidize corporate malfeasance.

Chopra began his lecture by articulating three objectives for his remarks. “First, I want to spend my time today talking about some specific examples of big firms that have repeatedly broken the law,” Chopra said. “Second, I want to explore a case study of the Federal Trade Commission’s handling of Facebook’s repeated violations of law. And finally, I want to describe some of the steps the Consumer Financial Protection Bureau and other regulators can take to halt recidivism and create a system that treats small and big firms equally.”

In addition to editing Chopra’s remarks lightly to accord with our style conventions, The Regulatory Review has divided his lecture into three parts to run as this series of three essays, each corresponding with one of his three objectives and each of the length to which readers of The Review are accustomed. On the third day of our series, we are releasing not only the final essay in this series but his entire lecture, as edited into a single integrated and downloadable article format, replete with footnotes.

Readers interested in the full version of his lecture released by the CFPB immediately following his lecture can visit the agency’s website. A video recording of the lecture can also be accessed at the Penn Program on Regulation’s YouTube channel.

The CFPB is a unit of the Federal Reserve System charged with protecting families and honest businesses from illegal practices by financial institutions and ensuring that markets for consumer financial products and services are fair, transparent, and competitive. As CFPB Director, Chopra not only leads the agency in pursuit of its mission but also serves as a member of the Board of Directors of the Federal Deposit Insurance Corporation and the Financial Stability Oversight Council.

Prior to his leadership of CFPB, Chopra served as a Commissioner on the Federal Trade Commission. At the FTC, he successfully worked to strengthen sanctions against repeat offenders, reverse the agency’s reliance on no-money, no-fault settlements in fraud cases, and halt abuses of small businesses. He also led efforts to revitalize dormant authorities, such as those to protect the Made in USA label and to promote competition.

Director Chopra previously served at the CFPB from 2010 to 2015. As the agency’s student loan ombudsman starting in 2011, he led the Bureau’s efforts on student lending issues. Prior to his government service, Chopra worked at McKinsey & Company, where he worked in the financial services, health care, and consumer technology sectors. Chopra holds a BA from Harvard University and an MBA from the Wharton School at the University of Pennsylvania.

Large Firms as Repeat Offenders

Regulators must not provide special treatment to dominant companies that are caught repeatedly violating the law.

September 26 | Rohit Chopra, Director of the Consumer Financial Protection Bureau

Lessons from the FTC’s Facebook Saga

The FTC’s settlement with Facebook does little to change or restrict recidivist business practices.

September 27 | Rohit Chopra, Director of the Consumer Financial Protection Bureau

Seeking Structural Remedies for Corporate Recidivists

To curb repeat violations, federal regulators should seek remedies that change businesses’ structures or alter their incentives.

September 27 | Rohit Chopra, Director of the Consumer Financial Protection Bureau

A fully formatted version of this entire three-part series is also available for download as a single, integrated PDF article.