The authors respond to RegBlog commentators and call for the end of “useless” disclosure requirements.

More Than You Wanted to Know surveyed mountains of evidence that mandated disclosure – requiring one party to a transaction to provide another with information for making better decisions about the transaction – has been a regulatory dead-end. The book showed that even in major areas like consumer, investor, and patient protection, where decades of dedication have been devoted to making mandated disclosure work, it chronically fails to achieve its goals.

Many disclosurites (people who implicitly or explicitly favor mandated disclosure) have now commented on More Than You Wanted to Know. To our eyes, the most significant feature of the comments is that they – especially sophisticated thinkers like the The Regulatory Review commentators – seem not to dispute, indeed, generally to accept, our core arguments that mandated disclosure’s record in its core areas is dismal and that its challenges are many and crippling.

After so much stalwart struggle but thwarted hopes, regulation scholars might be relieved to redirect their efforts and ingenuity to the hard but more rewarding work of devising better targeted, better gauged regulatory methods and persuading lawmakers to use them. Not so. Even sophisticated disclosurites cling to their battered hopes. They concede mandated disclosure’s dismal record but retreat to peripheral defenses, defenses that seek hopeful developments on the fringes of mandated disclosure.

One such defense is to read our argument more broadly than we stated it and then to attack the broader margins. For example, our book is not about or against information regulation. People need information, want many kinds of it, and can use it sensibly. The advertising industry would not thrive were people numb to information, nor would libraries, newspapers, universities, or Google. Society needs information regulation like rules against fraud, copyright and trademark protection, and vibrant and reliable networks of ratings, reviews, and other privately disseminated scores.

Our book is also not about reporting income to the IRS, or emissions to the EPA, or travel to Homeland Security. There, the government demands information to make command-and-control regulation feasible. Command and control is exactly what mandated disclosure aspires not to be; mandated disclosure is supposed to disseminate information, not concentrate power. Our book is about one specific but immensely popular form of information regulation – mandates obliging one party to a transaction to give the other information to make sound, informed, decisions. It is the disclosure that the Fed requires lenders to present to mortgage borrowers, not the reporting that the Fed elicits from banks in supervising their capital reserves or systemic risk.

Another peripheral defense is to search out an area where mandated disclosure seems to have had some glimmers of success. We don’t argue that all disclosure must always fail altogether, but the few modest successes are so dwarfed by the many major failures that the method must be fundamentally defective. Furthermore, on inspection even the occasional successes often seem problematic. Thus Ginger Jin, the author of fascinating empirical studies on regulation, writes in her contribution that mandated disclosure is successful in some areas. Like many of our colleagues who are food-labeling fans, Professor Jin reports, “I read the nutrition label of some grocery products.” So do we, sometimes, but we doubt that the benefits of such labeling accrue to the less literate, who need more help more urgently than hyper-literate disclosurites. Empirical studies we surveyed in the book show mixed and largely disappointing results for food labeling. People order slightly less from a calorie-labeled menu, but, still hungry, eat more between meals. And food (and drug) labels confuse many people in many ways. (Do you know how many chemical and non-organic ingredients the USDA’s “organic” label permits?)

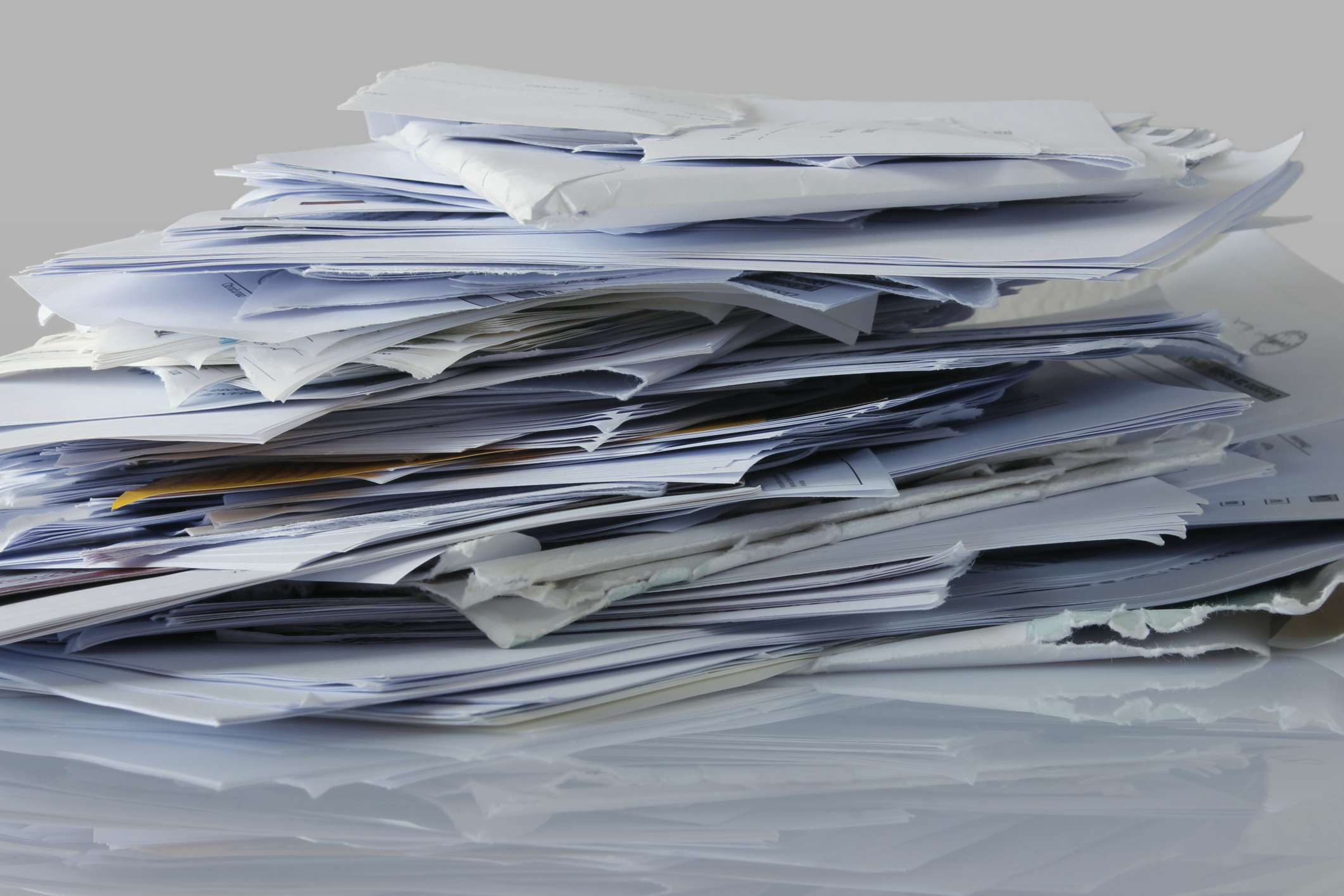

We regard calls for simplification – the deus ex machina of contemporary disclosurism – as yet another peripheral defense of mandated disclosure. We devote a chapter in the book to arguing that simplification has not only disappointed its advocates’ eager hopes, it has barely budged the meter. Simplification has turned out not to be so simple: every method that was tried over the past generation failed to make the improvements predicted by disclosurites. So the overwhelming trend is still toward grotesquely elaborate mandates. And because this trend is driven (among other things) by potent political and regulatory dynamics, it seems fated to persist.

So what agenda do we propose? Ideally, we advocate the repeal of all useless disclosures, not just because they are pointless, but because they aggravate the accumulation problem. Moreover, we want to deny lawmakers their easy escape from hard problems. None of this is politically pleasant, and some of it may be politically unattainable. But that is a poor reason to hold out false hopes to lawmakers and to encourage them to persist in solutions that, while politically feasible, fail. We hope the marvelous ingenuity and energies of the army of disclosurites can be shifted to the pressing task of telling lawmakers that mandated disclosure is no longer a respectable panacea and beginning to offer lawmakers alternatives that more directly and effectively address the problems mandated disclosure was supposed to solve.

This essay is part seven of a seven-part series on The Regulatory Review entitled, Is Mandatory Disclosure Helping Consumers?

Omri Ben-Shahar and Carl Schneider are the authors of More Than You Wanted to Know: The Failure of Mandated Disclosure.